nc estimated tax payment safe harbor

So rule 4 is really the only safe harbor that most physicians can actually count on. The safe harbor rules are as follows.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

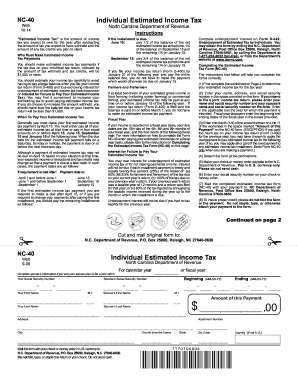

Estimated Income Tax is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim.

. This applies to taxpayers with adjusted gross income greater than 150000 or 75000 if married filing separately. Make one payment or. Estimated tax safe harbor.

2000 Form D-422 Web Underpayment of Estimated Tax by Individuals. Add the following other taxes from schedule 2 of 1040. Home File Pay Taxes Forms Taxes Forms.

If you expect to owe less than 1000 after subtracting your withholding youre safe. The safe harbor rule of estimated tax payments paying 100 of the taxes you owed in the previous year is sometimes referred to as the safe harbor rule. Tax you expect to have withheld plus.

Estimated payments are made quarterly according to the following schedule. Estimated payments are made quarterly according to the following schedule. Here is the main part of the Safe Harbor Rule.

Has there been a change in the law for Safe Harbor rules affecting estimated tax payments for high income taxpayers. Achieving Safe Harbor Through A Single Estimated Payment Thanks very much. Regarding the safe harbor rule of paying estimated taxes of 110 of last years tax liability is last years tax liability FIT SS Tax Medicare Tax.

The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. Safe harbor can be applied to estimated taxes giving you some leeway in how much you need to pay.

This applies to taxpayers with adjusted gross income greater than 150000 or 75000 if married filing separately. If youre estimating a down year so long as you pay within 90 of your actual liability for the current year youre safe. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe.

If your previous years adjusted gross income was more than 150000 or 75000 for those who are married and filing separate returns last year you will have to pay in 110 percent of your previous years taxes to satisfy the safe-harbor requirement. If your adjusted gross income AGI was less than 150000 last year then youll need to make quarterly estimated payments that total the smaller of 100. Article 4Clink is external Filing of Declarations of Estimated Income Tax and Installment Payments of Estimated Income Tax by Corporations.

North Carolina Individual Estimated Income Tax. Let us know if you need more help. Income tax you expect to owe for the year minus.

1st Quarter - April 15 2021 2nd Quarter - June 15 2021 3rd Quarter - Sept. The estimated tax Safe Harbor rule is based on 110 percent of the tax shown on the clients tax return. 110 of the tax on your 2012 tax return based on a safe harbor exception 100 if the adjusted gross income on your 2012 return was 150000 or less or 75000 if married filing separately or 90 of your actual tax for 2013 based on the annualized income installment method See Tax Tip 4.

Its complicated so Ill list the rules. What is individual estimated income tax. For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year.

Tax credits you plan. 15 2021 Paying 100 of the taxes you owed in the previous year is sometimes referred to as the safe harbor rule. Start with line 14 on your 2019 1040.

North carolina safe harbor estimated tax. And if certain conditions are met your penalty is waived or reduced. If your adjusted gross income for the year is over 150000 then you must pay at least 110 of last years taxes.

Take what you owed last year multiply it by 11 then divide it by four and send in a check for that amount every quarter. While every effort is made to ensure the accuracy and completeness of the statutes the North Carolina General. PO Box 25000 Raleigh NC 27640-0640.

The estimated tax Safe Harbor rule is based on 110 percent of the tax shown on the clients tax return. You must pay estimated tax payments for returns with taxable income of 50000 or more. Individual Income Tax Sales and Use Tax Withholding Tax.

The safe harbor estimated tax. Schedule payments up to 60 days in advance. Estimated tax payment safe harbor details.

2021 Payment Due Dates. To pay individual estimated income tax. No penalty is imposed if the amount paid for the current year is equal to at least 90 of the taxpayers current tax liability.

Individual estimated income tax. If you follow these methods you wont be subject to additional interest and penalties even if you still owe tax when you file your return. Use eFile to schedule payments for the entire year.

Schedule 2 Form 1040 or 1040-SR lines 4 6 additional. North Carolina Department of Revenue. Your link suggests If the adjusted gross income shown on the return of the individual for the preceding taxable year beginning in any calendar year exceeds 150000 clause ii of subparagraph B shall be applied by substituting 110 percent for 100 percent.

Doctors rarely qualify under rule 1 and rules 2 and 3 require you to somewhat accurately estimate your current tax bill. If your adjusted gross income for the year is over 150000 then its 110. The North Carolina General Assembly offers access to the General Statutes on the Internet as a service to the public.

The estimated safe harbor rule has three parts. Instructions for Form NC-40 North Carolina Individual Estimated Income Tax. The IRS has safe harbor methods for calculating your estimated tax payments.

The safe harbor rule of estimated tax payments. Want to schedule all four payments. Estimated tax payments must be sent to the north carolina.

How To Calculate Quarterly Estimated Taxes In 2021 1 800accountant

Understanding Individual Estimated Income Tax Payments And Safe Harbors Dermody Burke Brown Cpas Llc

North Carolina Estimated Tax Payments Fill Out And Sign Printable Pdf Template Signnow

Safe Harbor For Underpaying Estimated Tax H R Block

How To Calculate Quarterly Estimated Taxes In 2021 1 800accountant

Estimated Tax Payments And Retirement What You Need To Know Taxact Blog

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Instructions For Form 1040 Nr 2021 Internal Revenue Service

What Does The March 1 Deadline Mean For Farmers Center For Agricultural Law And Taxation

What If You Haven T Paid Quarterly Taxes Mybanktracker

Estimated Tax Payments For Independent Contractors A Complete Guide

Safe Harbor For Underpaying Estimated Tax H R Block